OLYMPIA, Wash. – Insurance Commissioner Mike Kreidler sent another letter today to insurers providing them with additional time to respond to his request for specific information about consumers’ premiums after they removed credit as a rating factor for auto, homeowners and renters insurance.

Twelve companies representing 5.2% of the auto insurance market responded to his initial request for specific data on how removing credit impacted their policyholders.

“I’m extremely disappointed that the majority of insurance companies are not being transparent with me or the people of Washington state,” said Kreidler. “The information I’ve requested is not trade secret. I simply want them to show me how this rule has impacted their policyholders and how they communicated the change to them. I’m beginning to wonder what they don’t want me or the public to see.”

He reached out to insurers in response to testimony he heard from policyholders during the public rule hearing on Nov. 23, 2021. Many consumers expressed their frustration over rate increases they experienced, despite not having filed any claims.

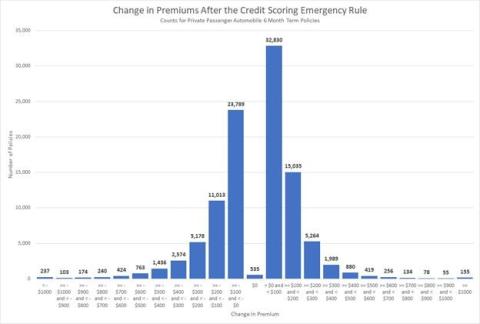

Kreidler’s rule was designed to be rate neutral, meaning any rate change would be spread across all policyholders, with some seeing a one-time rate increase and others getting a rate decrease. He asked the companies to provide a histogram illustrating the range of increases and decreases policyholders experienced and the communication they used to explain changes caused by the rule. A few insurers provided these illustrations in their original rate filings.

As an example, below is a histogram showing how the rule impacted auto policyholders on average for the 12 insurers that did respond:

“It’s also increasingly troubling that in lieu of transparency, the insurance industry continues to hide behind its lobbyists and associations,” Kreidler added. “I was not elected to regulate associations; I regulate and oversee the insurance industry in Washington state. And when I need additional information to ensure our policies and regulations have the intended impact, I expect all insurance companies to respond. If they do not, I believe we have a greater issue that needs addressing.”

Responses to his second request are due January 31.

Kreidler’s proposed rule would prevent insurers from using an individual’s credit history in the formulas they use to set rates for auto, home and renter insurance for three years. He proposed this rule in response to the economic harm many people experienced during the COVID-19 pandemic—harm that has been disproportionately borne by communities of color and those who were already financially vulnerable.

Although the federal CARES Act provides some protections for consumers, those protections do not apply to everyone. This makes the credit histories used by insurers temporarily unreliable and inaccurate. Because it is not clear when the public health emergency will end, the rule under consideration would require insurers to temporarily remove the inaccurate credit rating factor.